Fiscal and Monetary Policy

Ifo Institute for Economic Research, Munich, 2002

in: EEAG European Economic Advisory Group at CESifo: Report on the European Economy 2002 (CESifo Forum Special), 42-47

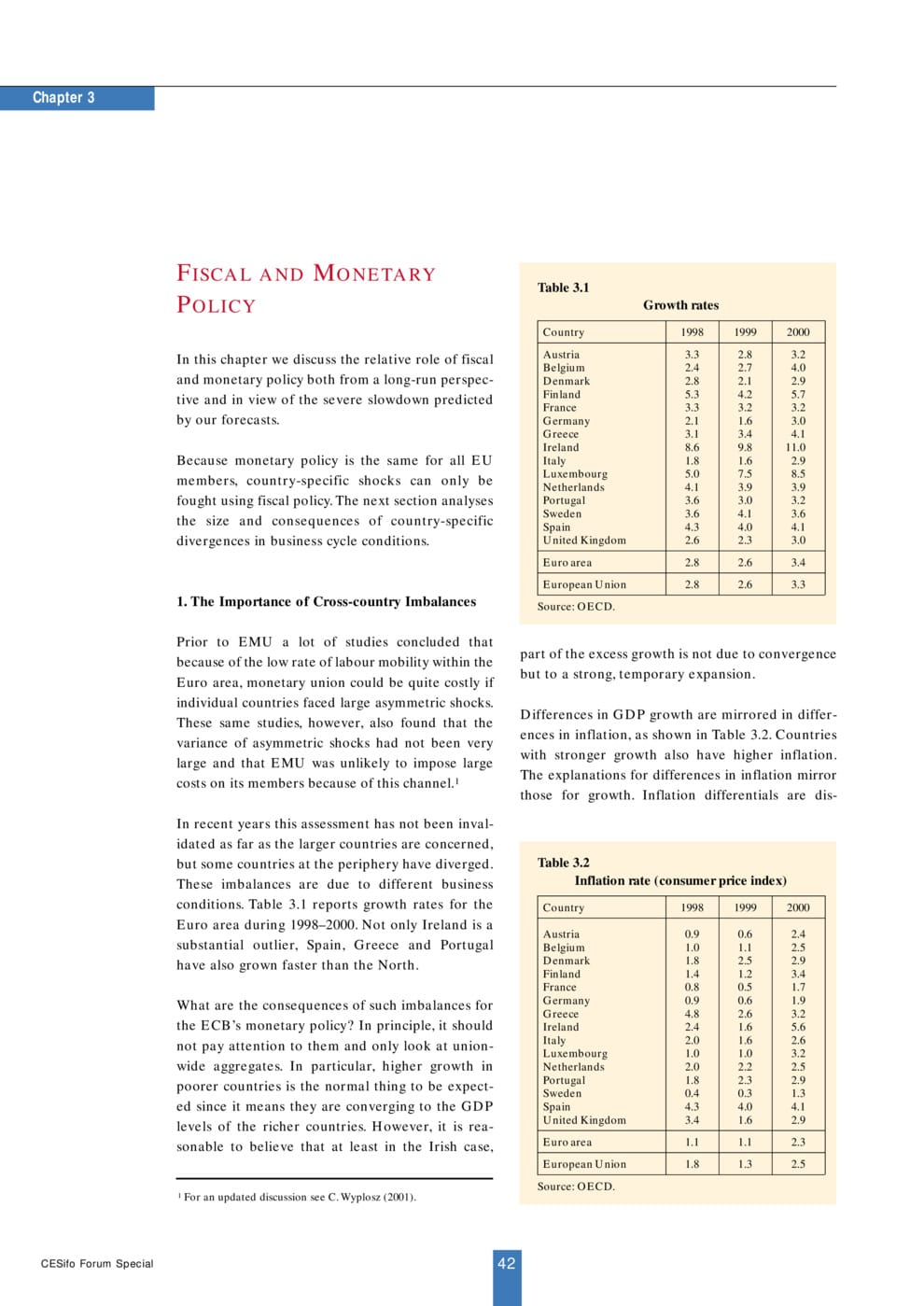

This chapter considers the monetary and fiscal policies appropriate to Europe under the circumstances of an adverse international cycle and a weak euro. Typically, governments have medium-term plans for fiscal consolidation, “stabilisation plans”, calling for a falling trend in budget deficits. The European Commission has called for this trend to be sustained and argued that the ECB should provide the necessary value-stimulus by cutting interest rates further. On the other hand Euro area interest rates are already lower than would be expected on the basis of the evolution of prices and output, and an indicator based on interest and exchange rates also indicates considerable easing of monetary conditions throughout 2001. It would be appropriate for deficits to rise throughout Europe during the current cyclical downturn, except where stabilisation efforts have been weakest, and debt income ratios are also highest, and even there they should not decline. We also believe that (especially as compared to the US Fed) the ECB has room to cut interest rates further – a measure which should be adopted sooner rather than later. It may also be appropriate to consider a contingency plan for a more radical and co-ordinated policy throughout Europe.

Included in

EEAG European Economic Advisory Group at CESifo: Report on the European Economy 2002

Ifo Institute for Economic Research, Munich, 2002